Taking a look at travel insurance

/Note: This post contains sponsored content and/or links.

So you’ve booked your holiday. Flights and accommodation have been sorted. You’ve added on any necessary hold luggage required and organised transfers at both ends.

But isn’t there something you’re forgetting?

That’s right – travel insurance! That thing you pay for, hope not to use, but, ultimately, could be essential to your time away.

It’s hardly the most exciting part of the trip-booking process, so it’s easily forgotten and put to the back of your mind. Some may even rely on others to sort it out (Mum and Dad, I’m looking at you).

Depending on the package you buy, the insurance will typically cover a range of things, from healthcare costs to gadgets insurance and everything in between.

But when away, travel insurance, that thing you cared so little about could become a vitally-important lifeline, especially because things like medical costs can run into the thousands. Not to mention if your luggage doesn’t arrive, you lose or have stolen personal belongings, or anything else that would otherwise incur a hefty fee.

So I spoke to Tom Boland from Manchester-based firm Cover4Insurance to find out more about getting covered.

Cover4Insurance offer several types of insurance and have done since 2009, but specialise in policies for students and young people. I do not represent Cover4Insurance, and all of my views are independent of theirs.

What types of travel insurance are there?

There are generally four main types of travel insurance and they are single trip, annual multi-trip, backpacker and winter sports – all of which are offered by Cover4Insurance.

Single trip is pretty self-explanatory and will cover you, or your family for one holiday. This is usually up to two or three weeks, but duration is dependent on your needs.

Annual multi-trip is advisable for those going to multiple countries over the period of a year but returning to their country of origin in between, as it will save both time and money on taking out multiple single trip policies. This is for trips less than 31 days for some companies, although Cover4Insurance cover up to 45 days as standard.

While the winter sports package is all you’ll need for that time away in a ski resort of your choosing.

They also offer backpacker insurance for continuous travel up to one year.

“We have a gap year or backpacker insurance, which can cover up to 12 months for someone going to either Europe, or worldwide,” explains Tom.

“There are a few different levels. The prices are determinant on whereabouts you’re going. So if you’re going to Europe it’s going to be cheaper than if you’re going to Australia or if you’re going elsewhere like America.

“But there are a few different options. It includes the medical side of it, including things like dental treatment or emergency burial costs and body repatriation.

“We also do things like personal possessions as well for things that you take with you, like your luggage.

“The main draw for our backpacker insurance is that it is so cheap. If you’re out of the country for long periods of time then it is more suited to you.”

You can find the original backpacker's guide blog post on Cover4Insurance's website.

How do I go about getting travel insurance?

It’s pretty simple. You can get a quote by either going online – C4I’s website can be found at cover4insurance.com – or over the phone, though Tom advises you go online.

“One way to reduce cover is to go online as there is no administration fee charged online.”

There is also the small matter of a calling fee, but it can make things easier being on the phone to someone as points in the small print can be clarified verbally, any concerns can be handled by an agent and you will be guided through the process by someone who knows what they’re doing.

But if you’re confident enough to proceed with the online route, which I’m sure most people will be, it’s a pretty straightforward process.

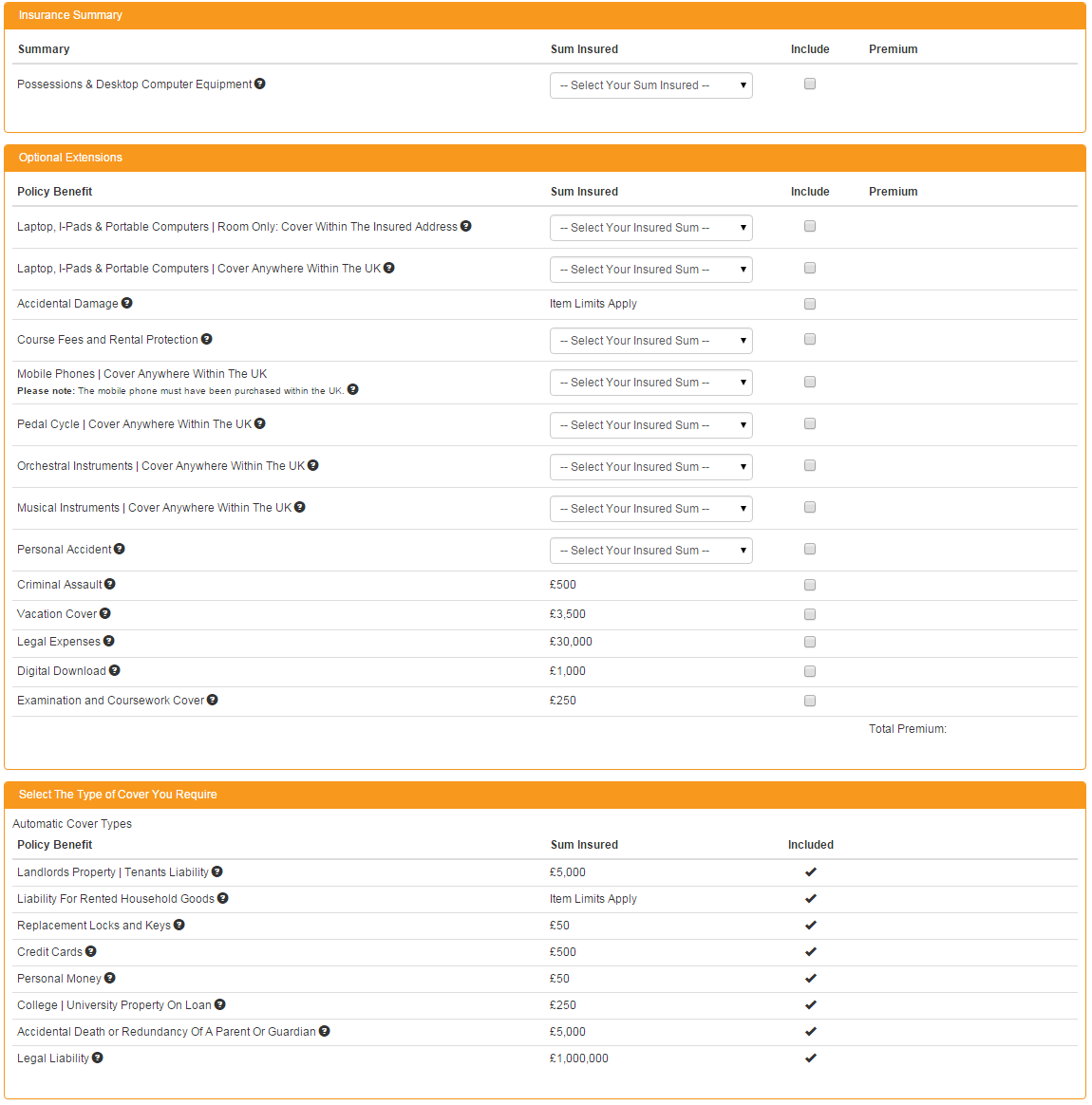

All you need to do is fill in a form like the one below, get a quote, then, if you’re happy with the price, continue with the purchase.

An example of one of Cover4Insurance's quote forms. They are quick and easy to fill out.

If you’re unsure or just want a quote for future reference, then you can retrieve it at a later date by using the quote reference you are given on receipt.

Just make sure you have all the relevant information to hand, because it will make your quote application a lot faster.

What else do I need to know?

After you’ve paid for the policy, cancellation cover will kick in. “Cancellation cover is really designed to cover you, say if you’re not going for another few weeks, from the minute you purchase the policy with us you are then covered for the cancellation or curtailment,” says Tom.

“It means that if something happens before you travel, such as if you fall ill and are unable to continue and go on the trip, we’ve got it covered, depending on which product you go for.

“As long as it wasn’t a pre-existing condition, so say for example you knew you weren’t going to go on the journey because something had happened, like if you fall ill and then you want to take out insurance because you feel like you’re not going to be able to make it onto the trip, then we wouldn’t be able to cover that.

“But if you’ve already booked flights or you’ve booked hotels and you need to insure, if you’ve already done that and then get insurance after that, that’s no problem at all. You’ll still be covered for cancellation as soon as you’ve paid us the premium.”

This is unlike some other insurance providers, whose cancellation cover strictly applies to bookings made after the policy is taken out. This is something you should be aware of.

It is also important that all insurance documents are read before the start of a trip, so that if there are any mistakes or additional things you want to be covered for that aren’t, then amendments can be made beforehand.

But you don’t actually need paperwork by your side. “If you’ve got access to the emails that we send – we do an electronic copy of our documents – on there will be all the contact numbers you’d need. You can obviously make a note of the contact when you go away, which would be advisable,” said Tom.

And although each claim is a case by case basis, there are two main ways, using a healthcare scenario as an example, to go about claiming on your policy.

"For anything less than £250 in medical costs, such as the treatment of a sprained wrist, you'd seek the medical help first and them come to us to claim it back.

"Or if you were in hospital and expected the costs might be higher, you would call our 24 hour claims line who would then liaise with the doctors to arrange the treatment and the payments of the fees."

Cover4Insurance are also popular amongst students

Students can study with the confidence that a Cover4Insurance policy can give them. Image credit: hackNY.org/Flickr

Not only do Cover4Insurance provide extensive levels of travel insurance, but according to Tom they are also popular with the student population, too.

“Students who aren’t living in halls anymore can take out insurance with us as well. But a lot of the halls across the country are covered by ourselves.

In addition to offering students insurance for their halls of residence, covering things such as electronics and gadgets, they have now started to provide insurance for those wishing to study abroad.

“The study abroad product that we do is specifically designed for the student market who are going away to do their university course.

“Since the tuition fees have gone up in the last few years, more people are looking to do their entire university course abroad, so we’ve got a product suitable for that, as well.”

A look at what students can have covered with Cover4Insurance.

Cover4Insurance provide both travel and student insurance, but also cover other areas such as home, tenants and landlords insurance. For more information visit their website, or give them a call on 0161 772 3382 (charges apply).

Travelling alone can be both daunting and exhilarating, so, to help with your debut, here are 11 tips for your first solo travel adventure.