A safe way to spend and store your money while travelling

/Using my eurochange Multi-Currency Cash Passport in Amsterdam.

Money and travel are intrinsically linked, but when you’re booking a flight and a hotel well in advance of your trip, it’s easy to think: “My flights were £40, and my hotel was £80 for three nights – I’ve just booked a holiday for £130!” But that £130 is never the true cost, because there’s always the matter of spending money.

Over the years, I’ve always taken cash away with me and ordered in advance where possible. It usually helps to have some of the local currency when you rock up to a foreign land – particularly if I’m arriving at an airport really late or really early, when currency kiosks are likely to be closed.

Some of the people I’ve travelled with have taken a different approach – one of the lads in Ayia Napa took a pre-loaded card and used ATMs, while one of my mates decided to use his new Revolut card for his spending on our trip through Italy last year. The reason they preferred card to cash was mainly safety – if they lost it, it’s unlikely they lose the money as well – after all, the monetary value is electronic, not tangible like a note.

I’ve always been hesitant, though. ATM fees, a worry of certain places not taking cards and a routine-attitude when it comes to acquiring foreign currency mean that I’ve always opted for cold hard cash, stashing the remainder in my hotel room whenever I head out to explore.

But when eurochange got in contact with me recently to trial their Multi-Currency Cash Passport, I was intrigued. Here I had the chance to step into the 21st century and use plastic instead of paper, and it was an offer I took them up on. So, when I went to Amsterdam last month, I had the chance to try it out. Here’s what I thought.

The good

Ease of use: One of the best things about the card was how easy it was to use. Activating it and making purchases couldn’t have been a smoother process. All I had to do was download the app, input my details and I was good to go.

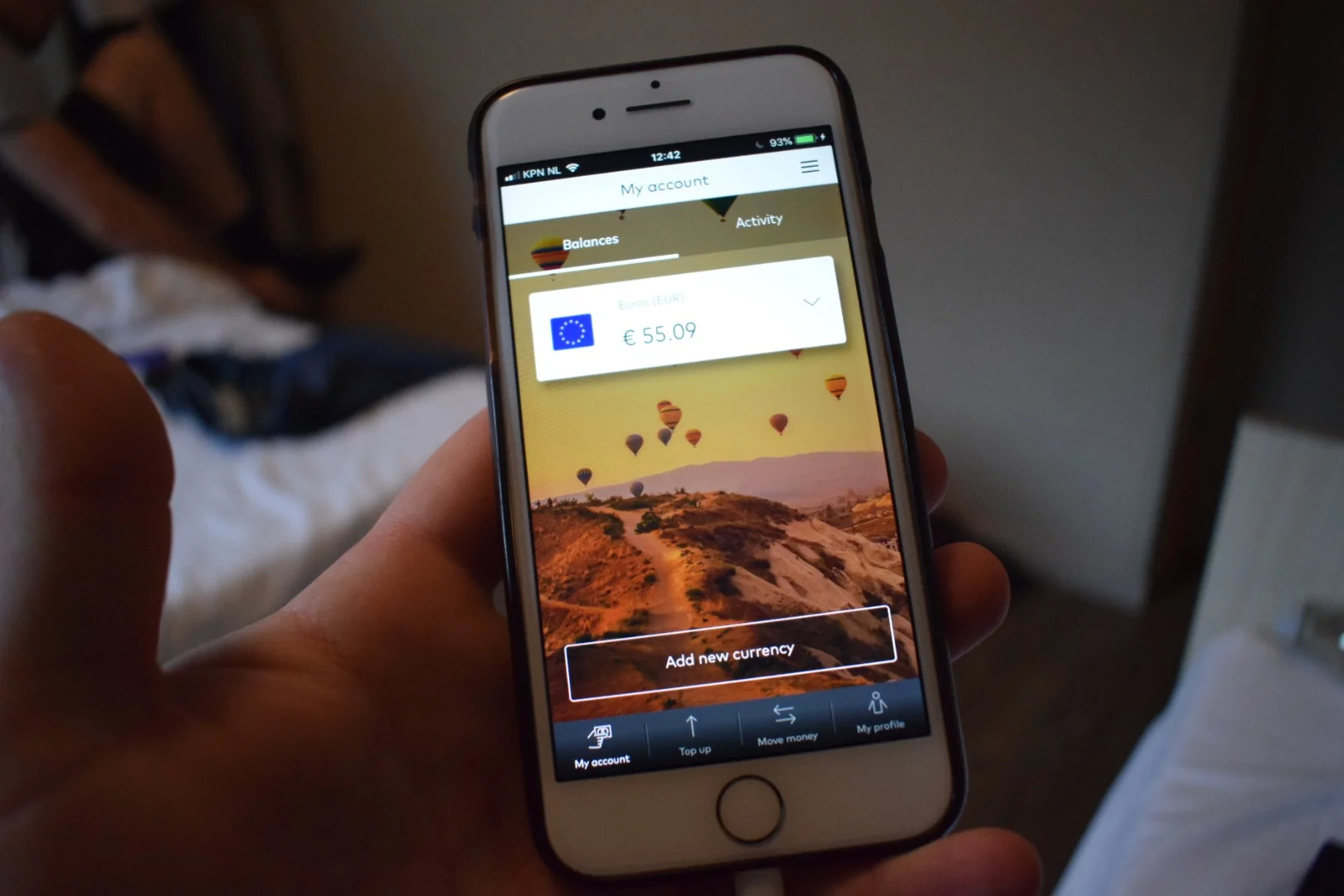

Tracking spending: Definitely my favourite thing about eurochange’s Multi-Currency Cash Passport was how easy it was to track my spending. Immediately after I had made a purchase using my card it would appear in the app, and while they did show as pending transactions, the amount had been deducted from my balance so that I could see exactly how much money I had left in my account, making it easier to budget and think ahead.

The app is easy, simple to use and gives you a live look at your balance.

Moving currency around: The Multi-Currency Cash Passport does exactly what it says on the tin, and that’s give you access to 10 global currencies at the tap of a screen. I thought this was an awesome way to manage money, especially if you’re travelling to several countries. If you were doing travelling in England, then moved on to France and into Switzerland, you can make the seamless switch from Great British Pounds to Euros to Swiss Francs all via the app. Easy.

Safety: Money will forever be a traveller’s concern because, let’s face it, it enables most trips. If you’re going to travel around Australia and New Zealand for a year, for example, you don’t want to be taking stacks of cash with you as it isn’t practical and poses a security threat. But eurochange's Multi-Currency Cash Passport takes the hassle and stress out of that, and you can switch between Australian and New Zealand Dollars at your own leisure.

The not-so-good

Setting it up: Although using the card was great acquiring it was a slightly different story. I went across to eurochange in the Trafford Centre on my lunch break one afternoon, and what I anticipated would take no longer than five minutes turned out to be a trip in excess of half an hour, due to the forms I had to fill out and the identification I needed to produce.

In the grand scheme of things, it really is no big deal. But if you are going to get a eurochange Multi-Currency Cash Passport, I’d recommend doing it online. Then you can do it at a time that’s convenient to you and get it delivered right to your door. Simple.

ATM fees: While financial safety is definitely a plus point, it can come at a price. One reason that taking cash when travelling is that you always have money to hand, and don’t need to rely on withdrawing from an ATM when having paper money becomes a necessity. Not only does that mean hunting for an ATM but, quite often, foreign ATMs carry charges for cash withdrawals. Although it is potentially an added cost, I suppose it’s a small price to pay if you’re conscious of carrying cash around.

If you would like to get your own eurochange Multi-Currency Cash Passport, or to find out more information about it, head to their website.

eurochange gave me the chance to try out their Multi-Currency Cash Passport in Amsterdam last month. Here’s what I thought.